Customs consulting

Many foreign exporters tend to establish their own legal entities in Russia which act as importers of record. Thus, the trend for so-called «direct supplies» (i.e. supplies without distributors and intermediaries) is now quite widespread in Russia.

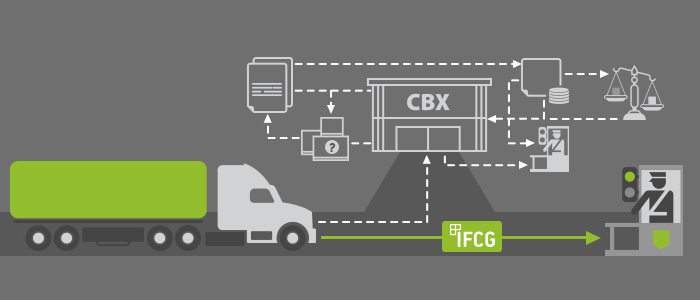

Of course, importers have to deal with Russian customs service and it is no secret that customs clearance in Russia can be a real issue.

Russian customs legislation is rather complicated even for Russian companies. Moreover, it is constantly being changed due to numerous foreign and domestic policy issues (e.g. establishment of the Eurasian Economic Union among Russia, Belarus, Armenia, Kyrgyzstan and Kazakhstan, sanctions and counter-sanctions, etc.).

Russian customs bodies often abuse the above situation and charge the importers and exporters with additional customs payments (e.g. customs duty, import VAT) which actually should not be paid. Furthermore, customs bodies often demand additional documents (e.g. certificates, licenses etc.) which are not stipulated by current legislation and thus should not be demanded.

For this reason, if you are either importing goods into Russia or just planning to do that, do not hesitate to apply for our high-quality advisory services to prevent possible customs issues which may arise.

Most common advice scopes

- Customs valuation issues, such as:

- what should be included into customs value and what should not;

- which valuation methods customs bodies should apply in your specific case and why;

- other issues.

- Tariff codes applied in Russia

- Exemptions from customs duty and import VAT, e.g.

- importation of goods as in-kind contribution to the charter capital of a Russian company;

- importation of certain types of technological equipment which is not produced in Russia.

- Minimizing customs payments by using specific customs procedures (i.e. temporary importation, inward processing etc.)

- Declaring goods to customs bodies (the list of documents which should accompany a customs declaration and other practical issues)

- Eurasian Economic Union: practical issues and on-going changes

- The liability for violations of customs rules (fines, seizure of goods etc.)